Data on long term trends in investment and economic growth

This post deals with the historic trend of investment and economic growth. This may appear a relatively esoteric topic. In fact, however, it has decisive economic and strategic business consequences - in particular for understanding the more rapid growth of the key Asian economies relative to the US and Europe and why this will continue for a prolonged period. Before dealing with these and other more detailed implications, however, the factual data is set out.

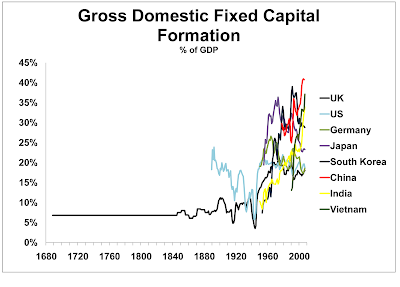

Figure 1 shows the percentage of fixed investment (gross fixed capital formation) in GDP for a series of major countries over the longest periods of time for which data is available. [1]

Figure 1

The pattern is clear and striking. By far the strongest trend is for the proportion of GDP devoted to fixed investment (gross domestic fixed capital formation) to rise with time. This in turn, as will be shown, is associated with progressively rising rates of economic growth.

Considering countries in the chronological order in which a new peak in the proportion of GDP devoted to gross fixed domestic capital formation appeared the following is the historical pattern.

- Commencing with the period immediately antedating the industrial revolution, the proportion of GDP devoted to fixed investment in England and Wales, at the end of the 17th century, was 5-7 per cent. [2] This rose slightly, although current estimates are that it did not rise greatly, during the 19th century - peaking at over ten percent of UK GDP prior to World War I.

This level of investment was sufficient to launch the first industrialisation of any country but at a rate of growth which, while unprecedented at the time, was extremely slow by contemporary international standards - about two per cent a year. With such a growth rate it takes 35 years for an economy to double in size and 70 years to quadruple.

- Turning to the latter part of the 19th century, the proportion of US GDP devoted to fixed investment had risen to considerably exceed that for the UK – reaching a level of 18-20 per cent of GDP by the last decades of the century.

A sharp fall in the proportion of the US economy devoted to fixed investment commenced in the late 19th century, and was particularly pronounced during the period between World War I and World War II – being associated with the great depression of the inter-war period. After World War II the US resumed its pattern of 18-20 per cent of GDP being devoted to gross fixed capital formation. This generated an average growth rate of 3.5 per cent a year. With such a growth rate an economy doubles in size every 20 years and quadruples in size every 40 years. It was on the basis of this historical level of investment, and growth rate, that the US overtook Britain to become the world’s greatest economic power.

- In the period following World War II Germany achieved a level of fixed investment exceeding 25 per cent of GDP – peaking at 26.6 per cent in 1964. This period 1951-64 was that of the post-war German ‘economic miracle’ with average growth of 6.8 per cent a year - with such a growth rate an economy doubles in size every 11 years and quadruples in 22 years.

- Starting at the beginning of the 1960s Japan achieved a level of gross domestic fixed capital formation of more than 30 per cent of GDP. This reached a peak in the early 1970s, at 35 per cent of GDP, before later sharply falling. During that period the average annual rate of growth of the Japanese economy was 8.6 per cent. With such a growth rate an economy doubles in size in eight and half years and quadruples in size in 17 years.

- From the 1970s onwards, South Korea similarly achieved a level of fixed investment of 30 per cent of GDP. During the 1980s this rose above 35 per cent of GDP. The other East Asian ‘Tiger’ economies – Singapore, Hong Kong and Taiwan – showed a similar pattern. South Korea’s economy confirmed the relation between fixed investment and economic growth illustrated by Japan by growing in this period by an average 8.3 per cent a year. At such a growth rate an economy doubles in size in nine years and quadruples in 18.

Such growth rates in Asia showed that something unprecedented in human history was now possible – that it was possible to industrialise an economy, and achieve a ‘first world’ level of development, in a single generation.

- From the early 1990s onwards China achieved sustained rates of fixed investment of 35 per cent of GDP with, from the beginning of the 21st century, this rising to more than 40 per cent of GDP – a level never before winessed in human history. The result was average 9.8 per cent a year economic growth over a sustained period – also the most rapid sustained economic growth ever seen in human history. On that basis an economy doubles in size every seven and a half years and quadruples in size in 15 years.

- To complete the chronological picture, the proportion of GDP devoted to fixed investment for two countries recently undergoing rapid economic growth, India and Vietnam, is shown. The proportion of Indian GDP devoted to fixed investment has not reached the Chinese level but has become high – reaching 34 per cent of GDP in 2007. On this basis, in the last five years, India has achieved an average growth rate of 8.8 per cent a year. At that rate of growth India’s economy doubles in size in slightly over eight years and quadruples in sixteen and a half years.

In Vietnam the proportion of GDP devoted to fixed investment rose from 13 per cent in 1990 to 25 per cent in 1995 to 37 per cent in 2007. Economic growth has accelerated rapidly, rising to an average of 7.9 per cent a year in the five years up to 2007. At that rate of growth Vietnam’s economy doubles in slightly under 9 years and quadruples in size in 18 years.

Considering these trends, such a high level of investment is a necessary condition for rapid economic growth. No substantial country without comparable high levels of fixed investment has achieved such rapid rates of growth on a sustained basis. [3] But it is not a sufficient condition: the high level of investment is also linked to the scale of production, that is the size of the market being produced for. In a modern economy only large scale production can be efficient in the decisive sectors of production, requiring an orientation to the international market – this is particularly evident with such high levels of investment.

No purely national market, not even the US or China, is sufficiently large to maintain the most efficient level of production. As many others have frequently correctly stressed, high levels of investment must therefore be accompanied by an export orientation. [4] It is this high level of investment, accompanied by an export orientation, which was responsible for the rapid economic growth of South Korea, China, India and Vietnam.

Implications of different investment levels

There are a number of clear consequences of these factual trends (it must be stressed that this data, of course, deals only with long and medium term trends and is not a guide to short term fluctuations). Among the most important of these implications are:

- It provides a clear historical framework for understanding the present rapid growth of (primarily Asian) economies and why they will continue to grow far more rapidly than the US and Europe.

- China’s economy will continue to outperform India’s and the gap between the two will grow - and not shrink as some have suggested.

- There is no serious historical evidence for the thesis sometimes presented that China is oversaving/overinvesting. China therefore should seek to maintain, and not cut, its current savings and investment levels.

- Current US/UK economic policy, with its overwhelming emphasis on microeconomic efficiency of resource allocation, fails to address the most important economic issues and therefore will be unsuccessful – which will deepen the tendency for the key Asian economies to grow more rapidly than the US and Europe. The also provides a background to current issues in the credit crunch.

Taking these issues in more detail:

First, these trends place in wider historical context the present rapid growth of a number of (primarily Asian) economies. The latter represent the latest high point in the trend for higher and higher proportions of GDP to be devoted to fixed investment. Consideration of such trends therefore provides a clear theoretical underpinning for the evident current empirical fact that not only is Asia growing substantially more rapidly than the US and Europe but that it will continue to do so. The investment rates in the key Asian economies are not aberrantly high but merely the latest point in an historical trend.

Seen in long term historical perspective it is US and European savings and investment rates that are too low, not Asian savings and investment rates that are too high.

Second, given these historic trends, it is clear that on the basis of current macroeconomic trends China’s economy will continue to expand more rapidly than India's and that China will increase its economic lead over the latter.

This naturally does not mean anything other than that India is an extraordinarily important market. India’s economy is, at a realistic exchange rate, in Parity Purchasing Power (PPP) terms, the fourth largest economy in the world after the US, China and Japan.[6] India's economic growth, running at around at 8-9 per cent a year, is the second largest for any major economy in the world after China. However, China’s economy is already approximately two and a half times the size of India’s in PPP terms and is continuing to grow at one to two per cent a year more rapidly than India – this combination ensuring that the gap between China and India is widening and not narrowing. There is also no evidence from consideration of historical data that the factors invoked to claim that India’s economy will grow more rapidly than China’s, for example different demographic profiles, are crucial. The historical evidence is that it is the proportion of the economy devoted to gross fixed capital formation that is decisive. The fact that, until the present, the Chinese economy continues to devote a significantly higher proportion of the economy to fixed investment than India – 43 per cent compared to 34 per cent to take the latest available years, indicates that unless India catches up with China in terms of this area China will grow more rapidly than India.

Third, there is no evidence from this historical trend data for the argument that China is facing a basic crisis of oversaving/overinvestment, and therefore that China needs to lower its total savings level (i.e. savings including private, public and corporate saving) and to increase consumption - as some commentators, including the Financial Times chief economics commentator Martin Wolf, have stated. [5]

It is evident that China’s level of investment and saving is far higher than that of the US or UK. However the historical data make clear that China’s is simply the latest stage in the long term trend for an increasing proportion of GDP to be devoted to gross fixed capital formation. Given this rising historical trend it is entirely likely that in the future another country, or China itself, will have a higher proportion of GDP devoted to saving/investment than China today - yielding a higher rate of growth.

While, of course, short term fluctuations and adjustments may be required there is no historical evidence that China's savings and investment rate is excessively high - it is merely the latest stage in a long term international historical trend. Reduction of China’s investment and savings rate would lead to slowdown not only of China’s economy but also, because of its locomotive role in the world economy, a slowdown in the global economy. China should therefore be seeking to maintain, not reduce, its current high investment and savings levels.

Fourth, there is no evidence from the historical data that the 'quality of entrepreneurship' plays any crucial role in economic development. Or more precisely, and what is another way of saying the same thing, the quality of entrepreneurship and managerial effectiveness appears to be randomly distributed and therefore cannot explain differences in economic growth rates. There are no cases where, due to the 'quality of entrepreneurship', countries have experienced rapid growth without high levels of gross domestic fixed capital formation in GDP.

Fifth, present US/UK government economic policy, by according overwhelming centrality to dealing with microeconomic efficiency, is addressing relatively minor issues in terms of international competitiveness compared to that of dealing with inadequate saving and investment rates. The economic priorities of a number of rapidly growing Asian economies will therefore clearly be more effective than that of the US and UK.

Put in other terms, the implications for governments’ economic policies of the long term trends outlined here is that in a balance between seeking microeconomic efficiency in the allocation of resources, and seeking a high level of savings and investment, the high level of savings and investment is more important that the emphasis on microeconomic efficiency from the point of view of creating economic growth.

There is an entirely reasonable supposition that the microeconomic allocation of investment in South Korea or China, given the use of subsidised loans, cross forms of ownership in different branches of industry, higher capital/output ratios etc, is less microeconomically efficient than in the UK or the US. However the rate of growth of the South Korean or Chinese economies is much more rapid, over a sustained period, than that of the UK or US.

Quantitatively the greater microeconomic efficiencies in allocation of resources in the US or UK, to generate an equal rate of growth, would have to compensate for their lower savings and investment ratios and there is no evidence that it does so. It is the higher savings and investment rates in Asian economies that predominate over greater microeconomic efficiency. Therefore any quality of microeconomic priorities in the US and UK will be overwhelmed by the quantity of investment in the rapidly growing economies of Asia.

Ideally, of course, both high microeconomic efficiency and high savings/investment levels should be sought. However there is evidence that the two are contradictory. For example the policies pursued in the US and UK have been accompanied by massive declines of savings rates which have undermined the competitiveness of the economy – leading into present sharp financial problems. It is therefore likely that current US and UK economic policy will be unsuccessful, and these economies will remain under financial pressure created by lack of competitiveness for a prolonged period. The credit crunch is a one periodic form of the manifestation of this loss of competitiveness by the US and UK.

Conclusions

The following clear conclusion may be drawn from this data:

There is a clear historical trend for the proportion of the economy devoted to gross domestic fixed capital formation to rise. This is the key determinant of rising rates of economic growth.

Five key historic stages in the rise in this proportion of the economy devoted to fixed investment may be identified: the achievement of a 5-7 per cent investment rate in Britain in the 18th century permitting the launching of the industrial revolution; an 18-20 per cent of GDP fixed investment rate from the latter part of the 19th century, achieved by a number of countries led by the US, which permitted the United States to replace the UK as the world's leading economic power; a 25 per cent of GDP fixed investment rate in Germany in the immediate post-World War II period which accompanied the German 'economic miracle'; a more than 30 per cent of GDP rate of fixed investment achieved in Japan, and then the other East Asian 'Tiger' economies, from the mid-1960s which permitted growth rates of more than 8 per cent a year; a more than 35 per cent of GDP fixed investment rate in China from the 1990s onwards which has permitted sustained growth rates approaching 10 per cent a year.

On the basis of this differential in investment rates a number of the key Asian economies will continue to outperform the US and Europe in terms of economic growth for a prolonged period.

China will continue to increase its economic lead over India - although the latter will experience rapid economic growth.

There is no historical evidence China is oversaving or overinvesting and it should seek to strategically maintain, and not cut, its present investment and saving rates.

Current US and UK economic policy addresses secondary issues and therefore is unlikely to be successful.

* * *

This article originally appeared as 'Why Asia will continue to grow more rapidly than the US and Europe - a historical perspective' on Key Trends in Globalisation.

References

[1] The figure for England for 1688 is that in Angus Maddison, The World Economy, OECD Paris 2006 p395. UK figures after 1688 and up to 1947 are calculated from One Hundred Years of Economic Statistics, The Economist, London 1989 p74. Figures from 1948 are calculated from International Monetary Fund, International Financial Statistics (August 2008) Minor adjustments have been made to chain the earlier statistics to be consistent with the IMF data – in no case does this make any significant difference to the pattern shown. The data for fixed investment for the earlier period used by The Economist One Hundred Years of Economic Statistics are based on calculations in C H Feinstein and Pollard Studies in Capital Formation in the United Kingdon 1750-1820, Oxford University Press, Oxford 1988. Other commentators have suggested that Feinstein and Pollard's figures are somewhat too high - see for example. N F R Crafts British Economic Growth during the Industrial Revolution, Clarendon, Oxford 1986 p73. None of these revisions and differences however is of sufficient magnitude to alter the fundamental pattern shown here.

US figures prior to 1948 are calculated from One Hundred Years of Economic Statistics, The Economist, London 1989 p74. Figures from 1948 are calculated from International Monetary Fund, International Financial Statistics (August 2008) Data for the earlier period give only private fixed capital formation whereas that after 1948 is for total fixed capital formation – i.e. including government fixed capital formation. There are no reliable estimates of government fixed capital formation in the earlier period and therefore data for the earlier period have been adjusted upward by the difference between the two in 1948 – which is slightly over two per cent of GDP. This has the effect of revising upwards slightly the percentage of GDP allocated to fixed investment in the earlier period but the difference is too small to affect the overall pattern.

Figures for Germany prior to 1960 are calculated from One Hundred Years of Economic Statistics, The Economist, London 1989 p202. Figures from 1960 are calculated from International Monetary Fund, International Financial Statistics (August 2008). There is however no significant statistical difference between the two.

Figures for Japan, South Korea, China, India and Vietnam calculated from International Monetary Fund, International Financial Statistics.

[2] Phyllis Deane and W A Cole in British Economic Growth 1688-1959, Cambridge University Press, Cambridge 1980 p2 being closer to the lower figure while further studies have tended to revise the figure upwards slightly. The higher estimates for the earlier period have been taken here so as to avoid any suggestion of exaggerating the degree to which the proportion of GDP devoted to Gross Domestic Fixed Capital Formation has risen. The precise figure used here is that calculated by Maddison in Angus Maddison, The World Economy, OECD Paris 2006 p395. The higher figure, as can be seen, makes no difference to the overall trend.

[3] The only exceptions are the extremely small states, with populations of less than two million, of Equatorial Guinea and Botswana - which are so small their economic conditions can be essentially wholly determined by external factors.

[4] A particularly coherent theoretical explanation of this may be found in N Lardy Foreign Trade and Economic Reform in China, Cambridge University Press, Cambridge 1993.

[5] See for example Beijing should dip into China’s corporate bank and China should risk bolder trials. Similar views are expressed in The Growth Report: Strategies For Sustained Growth And Inclusive Development

[6] For a convenient survey of the latest calculations in this field see http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP.

No comments:

Post a Comment